franklin county ohio sales tax rate 2019

Ohio has a 575 sales tax and Franklin County collects an additional. The latest sales tax rate for Franklin OH.

The County sales tax rate is.

. The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1 2022. The sales tax jurisdiction. The total sales tax rate in any given location can be broken down into state county city and special district rates.

2020 rates included for use while preparing your income tax deduction. April Newell Income Tax Administrator. Groceries and prescription drugs are exempt from the Ohio sales tax.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. This is the total of state county and city sales tax rates. Missouri has a 4225 sales tax and.

There were no sales and use tax county rate changes effective October 1 2022. This is the total of state and county sales tax rates. The 725 sales tax rate in Franklin Furnace consists of 575 Ohio state sales tax and 15 Scioto County sales tax.

The latest sales tax rate for Franklin County OH. There is no applicable city tax. 123 Main Parcel ID Ex.

The Ohio state sales tax rate is currently. The Franklin County sales tax rate is. The Ohio sales tax rate is currently.

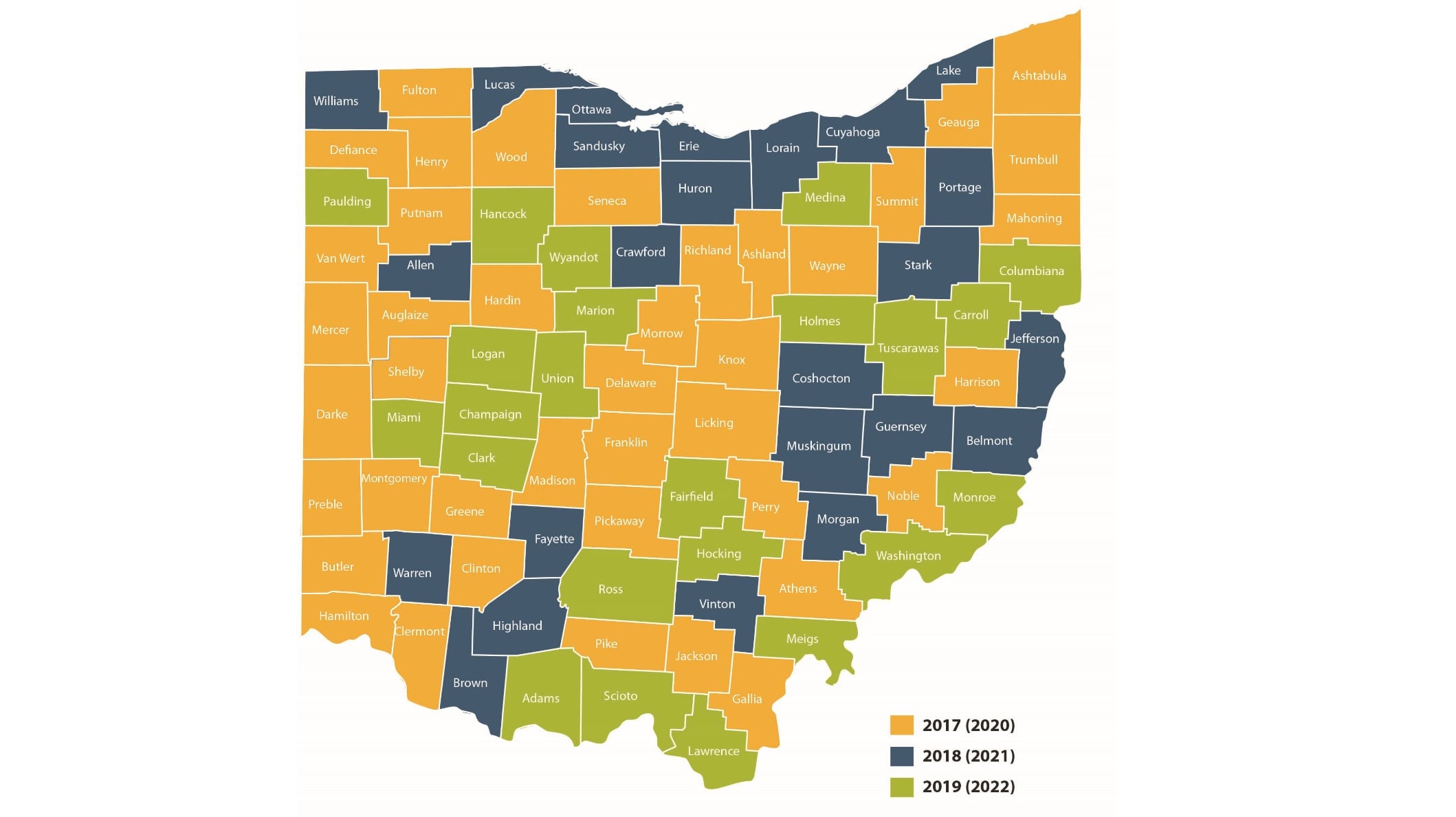

Map of current sales tax rates. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange.

Monday - Friday Excluding City Recognized Holidays 830 am. Tax Information for Estimated Resources. - The Finder This online.

1 Benjamin Franklin Way. Emails are unsecure and subject to public records request. 2021 PROPERTY TAX RATES FOR 2022 To learn more.

Ohio has 1424 cities counties and special districts that collect a local sales tax in addition to the Ohio state sales taxClick any locality for a full breakdown of local property taxes or visit our. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Tax Rate Histor y. - The Finder This online tool can help determine the sales tax.

2020 rates included for use while preparing your income tax deduction. Franklin County Sales Tax Rates for 2022. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax.

Counties and cities can. There is no applicable city tax or. The 2018 United States Supreme Court decision in.

130 130 - clinton township 280 1912 3474 8208 000 000 13874 0362371 0260837 88464735 102551475 0086493 0021623 0087899 0021974 MICHAEL STINZIANO 2019. The Franklin County sales tax rate is. The minimum combined 2022 sales tax rate for Franklin Ohio is.

1 lower than the maximum sales tax in OH. 075 lower than the maximum sales tax in OH. Some cities and local.

Original Full Year Charge by Political Subdivision Fund Class. Value by Political Subdivision. This rate includes any state county city and local sales taxes.

This rate includes any state county city and local sales taxes. 3 rows Franklin County OH Sales Tax Rate. DO NOT send personal information via email.

Income Tax City Of Gahanna Ohio

Local Income Taxes In 2019 Local Income Tax City County Level

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Amazon Com Franklin County Ohio Zip Codes 48 X 36 Paper Wall Map Office Products

Income Tax Repeal A Bad Deal For Ohio

Ohio Taxes Apps On Google Play

Sales Tax Map By Lorain County Ohio Government Issuu

Ohio Sales Tax Rates By County

Local Income Taxes City And County Level Income And Wage Taxes Continue To Wane Tax Foundation

Franklin County Experiencing Delays On Property Tax Rates Bills

Cutting Ohio Top Income Tax Rates Would Be Costly Favor A Few Policy Matters Ohio January 03 2005

Ohio Sales Tax Rates By County

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Explaining Ohio S Maze Of City Income Tax Rates And Credits And Why You Should Log Where You Ve Been Working That S Rich Cleveland Com

Income Tax City Of Gahanna Ohio

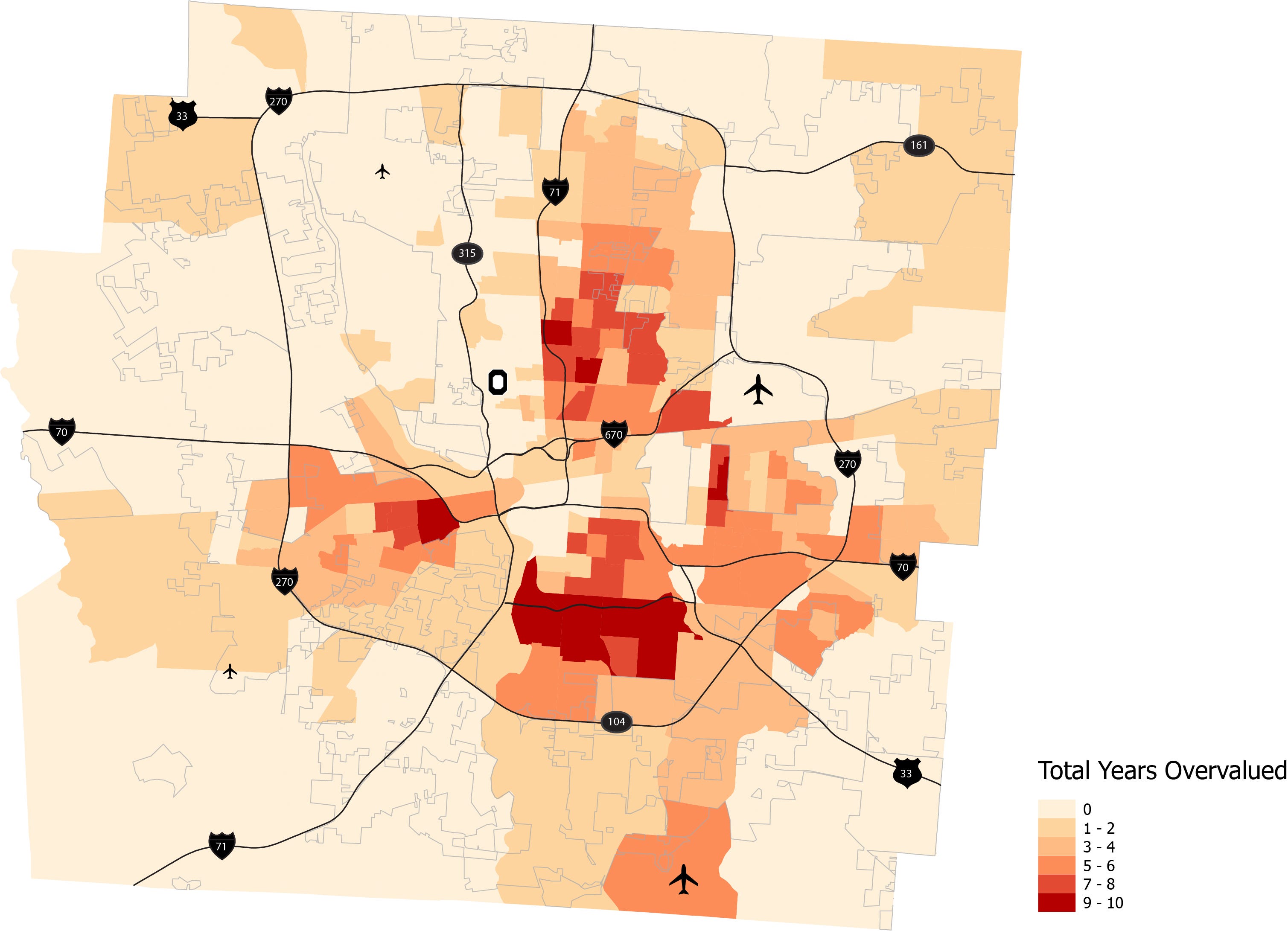

Franklin County Real Estate Taxes Overvalued Poor Black Neighborhoods

Franklin County Auditor S Office Fc Auditor Twitter

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More